Events - Event View

This is the "Event Detail" view, showing all available information for this event.

If the event has passed, click the "Event Report" icon to read a report and view photos that were uploaded.

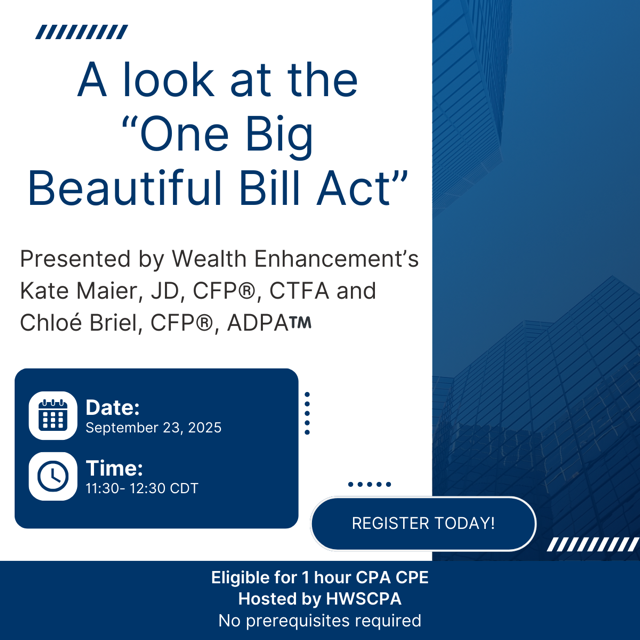

FREE - Fall Webinar (1 hour CPE) - OBBBA

If you are a member, please

log in to access additional, potentially lower registration fee options.

Registration Info

Registration is required

Prerequisites - None

About this event

|

•

|

Identify and explain the key individual tax provisions made permanent or expanded by the OBBBA Act, including changes to child tax credits, itemized deductions, and the Alternative Minimum Tax (AMT)

|

|

•

|

Describe significant business tax changes, including the reinstatement of business interest expense limitations, modifications to the Qualified Business Income Deduction, and the expansion of bonus depreciation

|

|

•

|

Recognize which clean energy tax credits and incentives have been phased out, limited, or extended, and assess the impact of these changes on tax planning for individuals and businesses

|

Number of People Who Will Attend

Search for your information - enter the following

* This can be your primary registrant type. Only one primary registrant type is allowed per registration.

Invalid Quantity

Register Now

Invalid Quantity

Register Now